√100以上 excel yield function formula 175584-Excel yield function formula

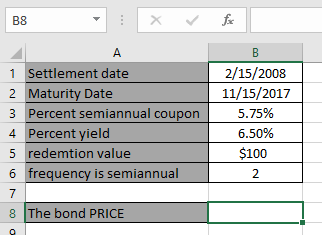

Formula =BDH(security, field(s), start date, end date) Example =BDH("SIA SP Equity","px_last", "12/30/08", "12/30/09") Bloomberg Data Set (BDS) BDS formulas gives multicells of data such as company description, index members' weightage, top holders, etc Formula =BDS(ticker, field) Example =BDS(PSI Index, indx mweight, "cols=2;rows=")Use the Yield Function to Calculate the Answer Type the formula "=Yield (B1,B2,,B4,B5,B6,)" into cell B8 and hit the "Enter" key The result should be percentwhich is the annual yield to maturity of this bondSimilarly to the CONCATENATE function, you can use "&" in Excel to combine different text strings, cell values and results returned by other functions Excel "&" formula examples To see the concatenation operator in action, let's rewrite the CONCATENATE formulas discussed above Concatenate the values in A1 and B1 =A1&B1

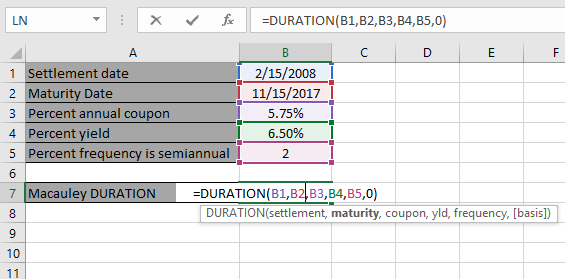

Function Duration

Excel yield function formula

Excel yield function formula-With the equation in this form, the LINEST function to return b and log 10 (a) can be set up like this =LINEST(LOG10(yvalues),LOG10(xvalues),TRUE,FALSE) Since the LINEST function returns b and log10(a), we'll have to find a with the following formula In Excel, that formula is =10^(number) That's it for nowFirst, Excel performs multiplication (A1 * ) Next, Excel adds the value of cell A3 to this result Another example, First, Excel calculates the part in parentheses (A3) Next, it multiplies this result by the value of cell A1

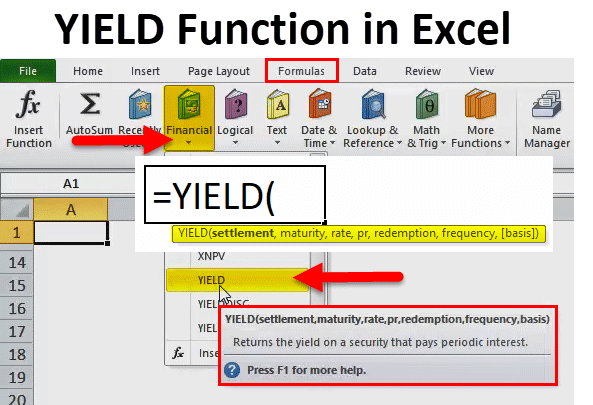

Yield Function In Excel Formula Examples How To Use Yield

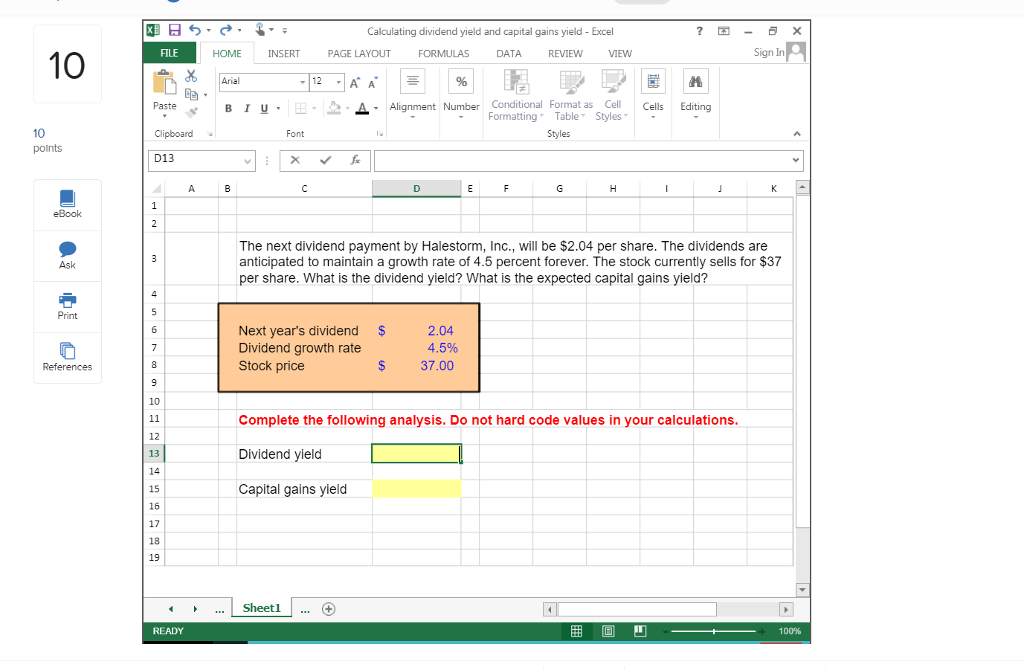

The Excel Price Feed Addin works by providing a library of new Excel formulas, most of which just require an instrument symbol or ticker For example to display the current price of Apple stock in a cell simply enter this formula =EPFYahooPrice("AAPL") How to find instrument symbols/tickersYIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price, principal amount and coupon payment frequency per year In the context of debt securities, yield is the return that a debtholder earns by investing in a security at its current priceThe formula to calculate dividend yield, therefore, is =D4/D3 Based on the variables entered, this results in a Dividend yield of 273% Calculating dividend growth in Excel (Current dividend amount ÷ Previous dividend amount) – 1 Using Excel to calculate dividend growth can give you an idea of how the dividend yield might increase in the future

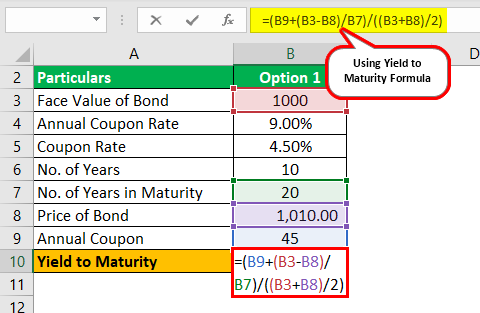

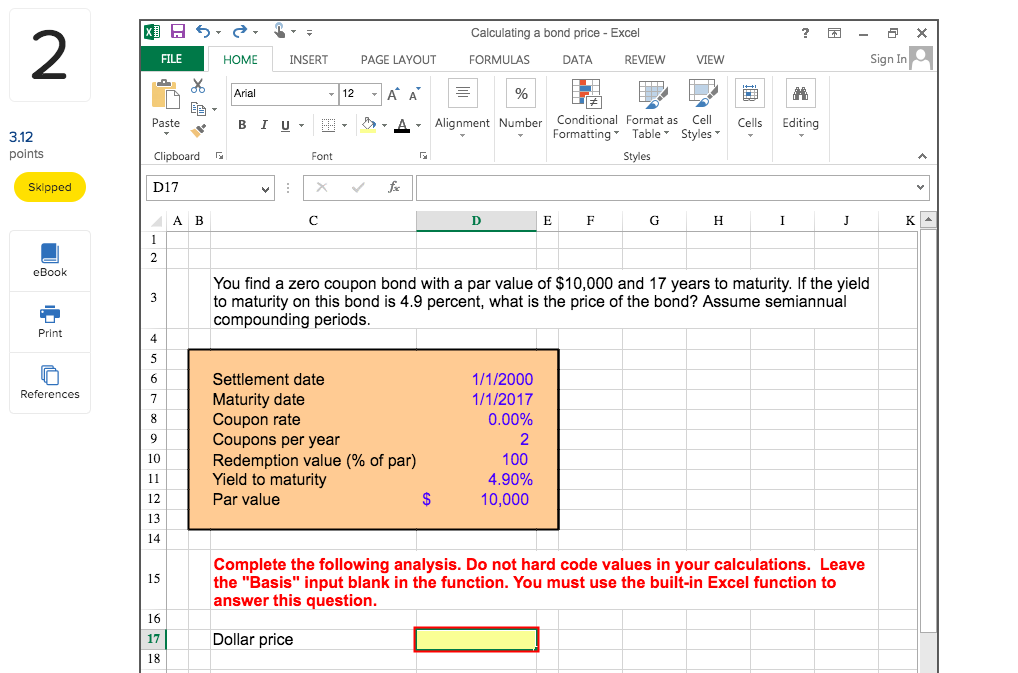

The formula to price a traditional bond is Calculating the Yield to Maturity in Excel The above examples break out each cash flow stream by year This is a sound method for most financialThe formula to price a traditional bond is Calculating the Yield to Maturity in Excel The above examples break out each cash flow stream by year This is a sound method for most financialRedemption is the value received by the bondholder at the expiry of the bond representing the repayment of principal;

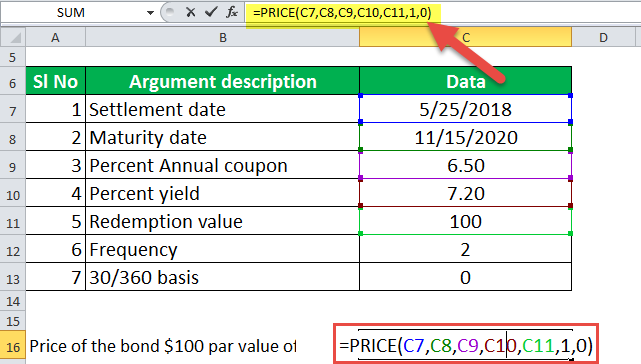

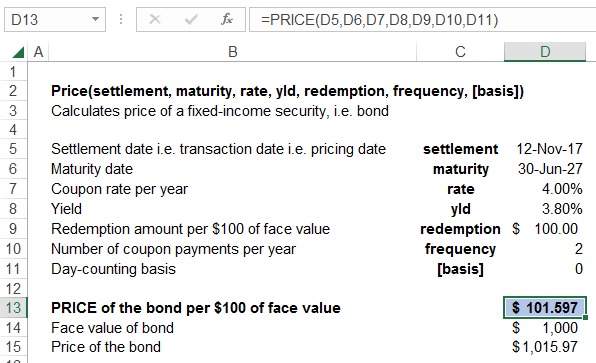

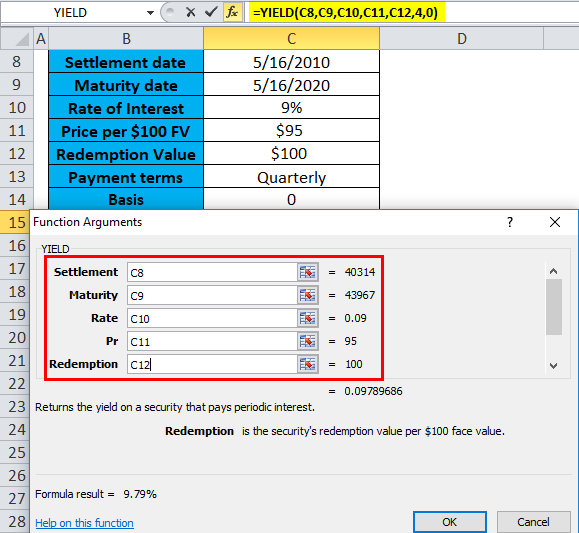

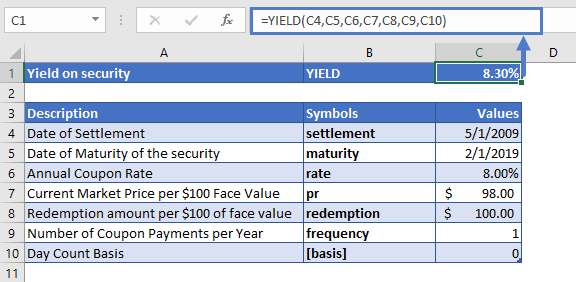

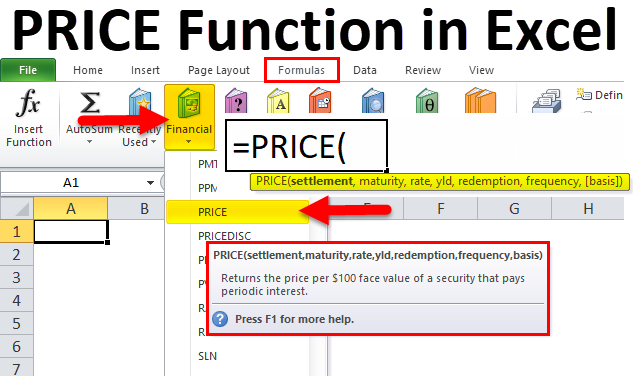

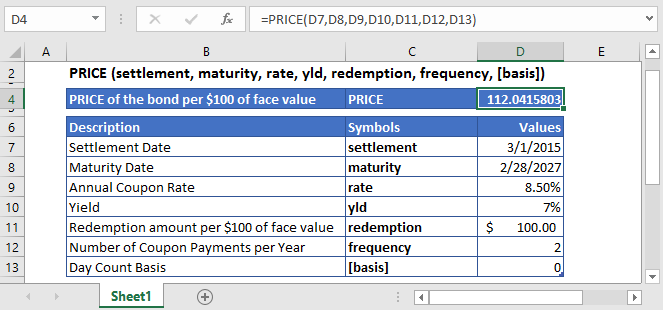

The formula for current yield is very simple and can be derived by dividing the annual coupon payment expected in the next year by the current market price of the bond which is then expressed in percentage Mathematically, it is represented as, Current Yield = Annual Coupon Payment / Current Market Price of BondThe Formula used for the calculation of Price of the fixedincome security is =PRICE(C4,C5,C6,C7,C8,C9,C10) The PRICE function returns the following price of the fixedincome security per $100 face value of a security that pays periodic interest PRICE = $44Enter the following function into B19 =YIELD(B6,B8,B4,B13,*(1B9),B10,B11) You should find that the YTC is 1517% As noted, the nice thing about the Yield() function is that it works correctly on any day of the year To see this, change the settlement date to 12/15/07 (halfway through the current coupon period)

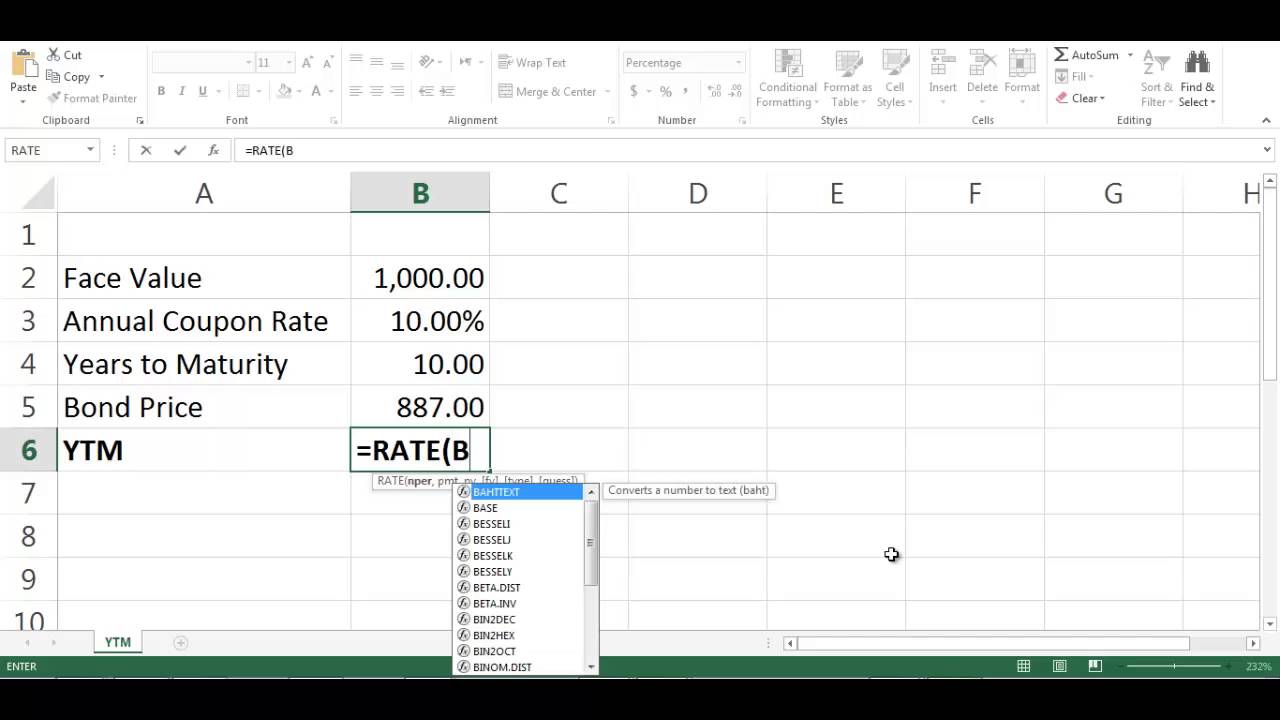

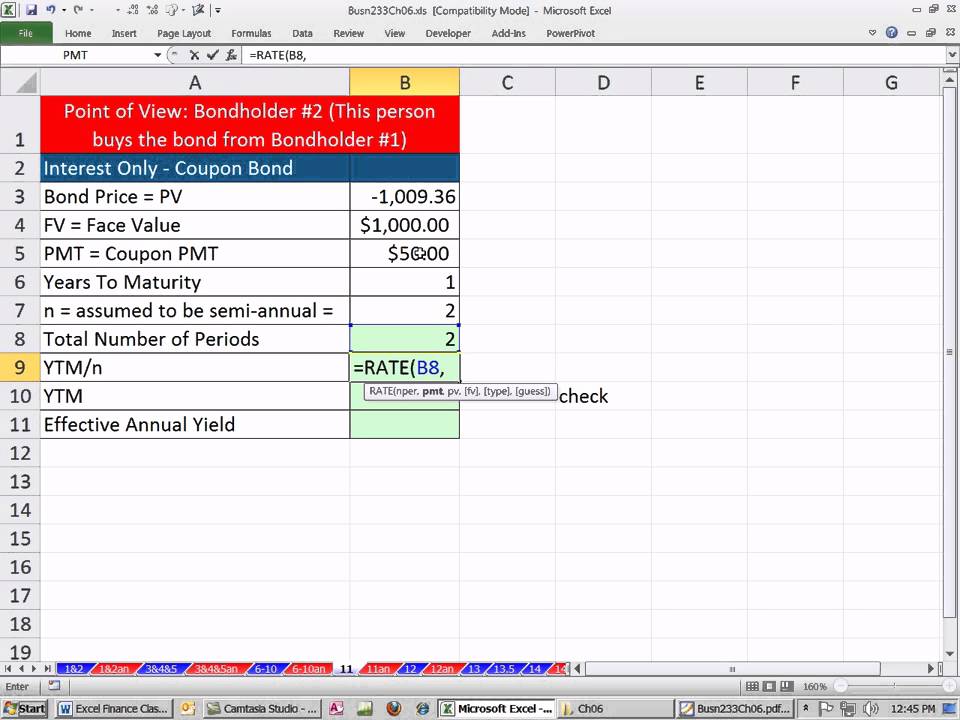

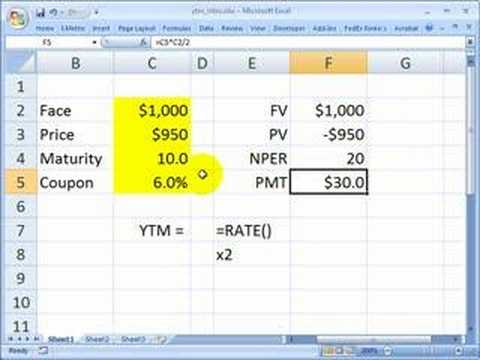

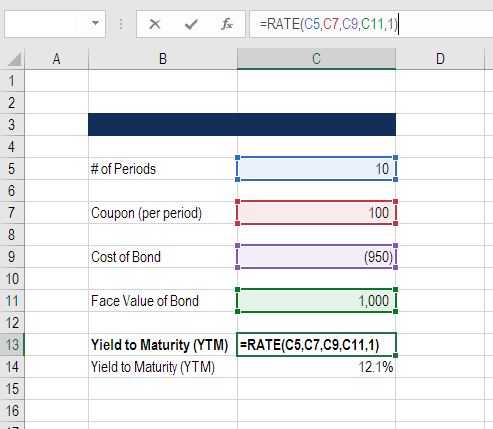

Best Excel Tutorial How To Calculate Ytm

Excel Yield Function

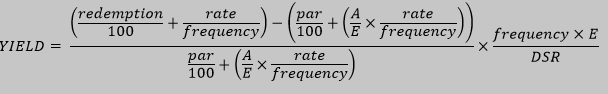

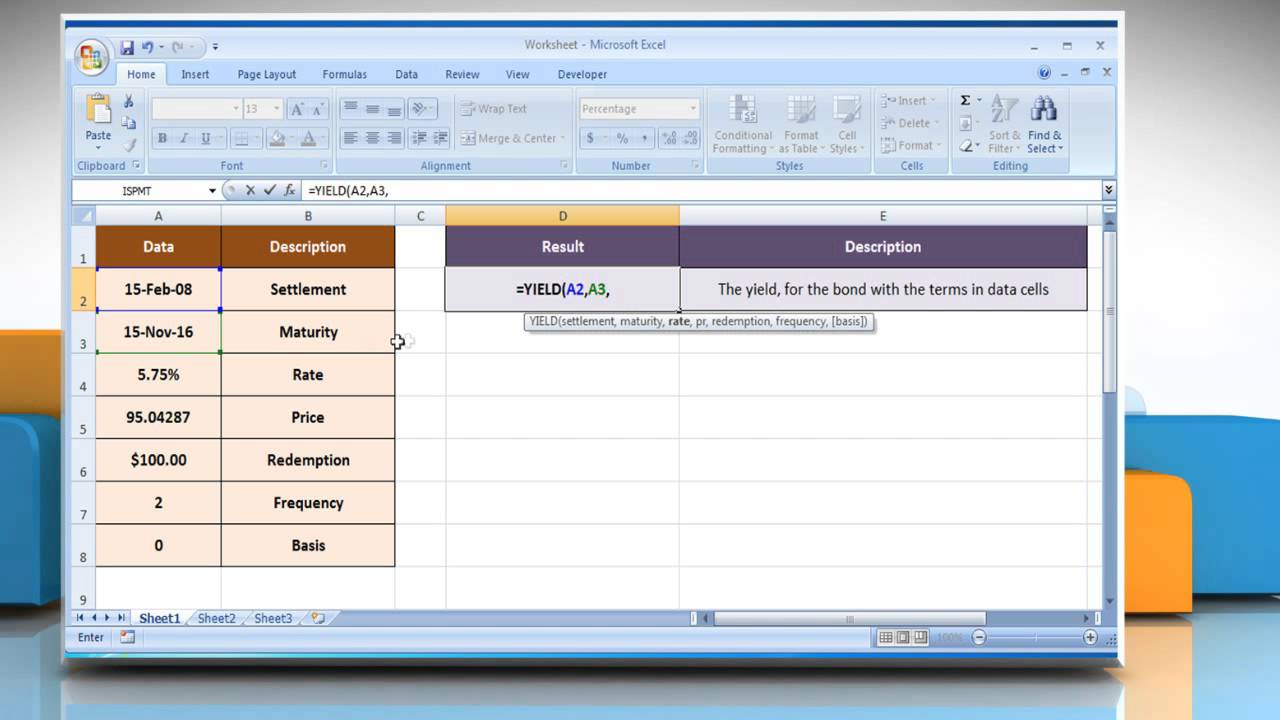

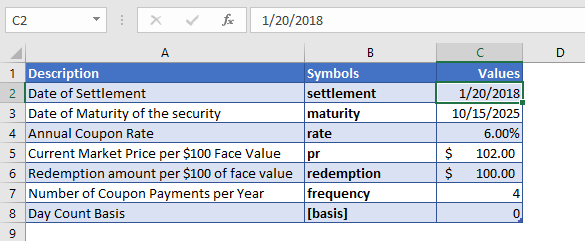

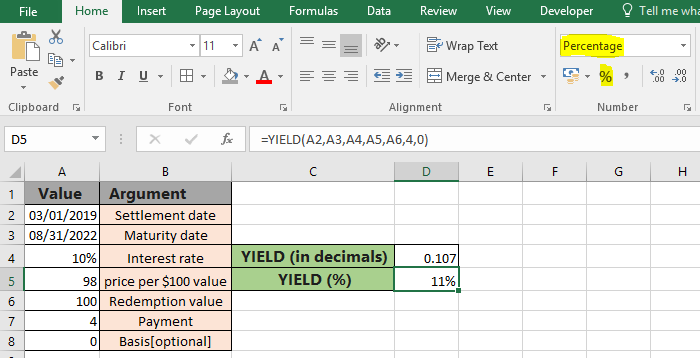

The resolution uses the Newton method, based on the formula used for the function PRICE The yield is changed until the estimated price given the yield is close to price Example Copy the example data in the following table, and paste it in cell A1 of a new Excel worksheet For formulas to show results, select them, press F2, and then press EnterIn this video, we are going to learn how to use YIELD function in excel using YIELD Formula𝐘𝐈𝐄𝐋𝐃 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐢𝐧The Excel YIELDMAT function calculates the annual yield of a security that pays interest at maturity The syntax of the function is YIELDMAT( settlement, maturity, issue, rate, pr, basis) Where the arguments are as follows settlement The settlement date of the security (ie the date that the coupon is purchased)

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Price Function In Excel Formula Examples How To Use Price Function

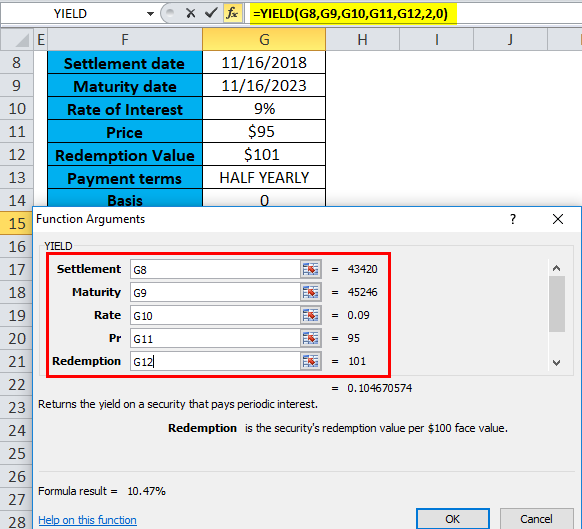

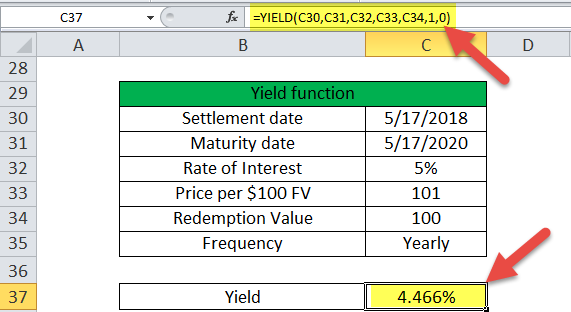

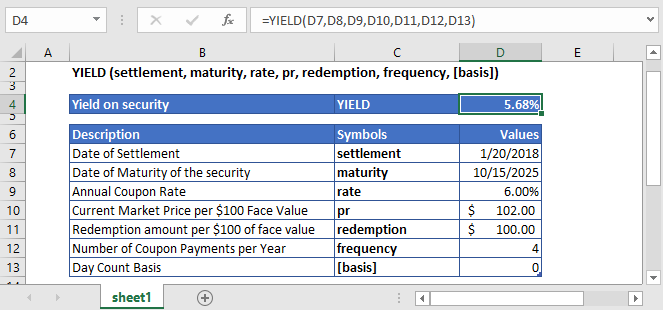

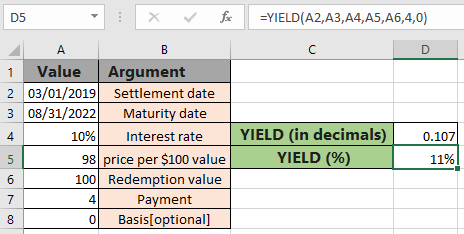

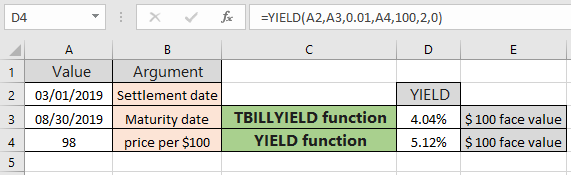

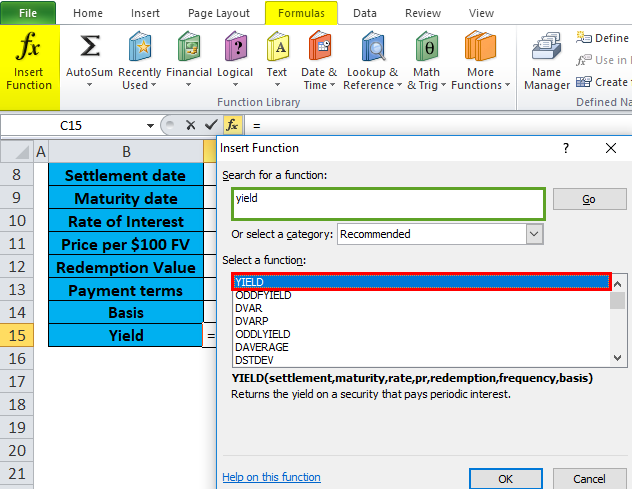

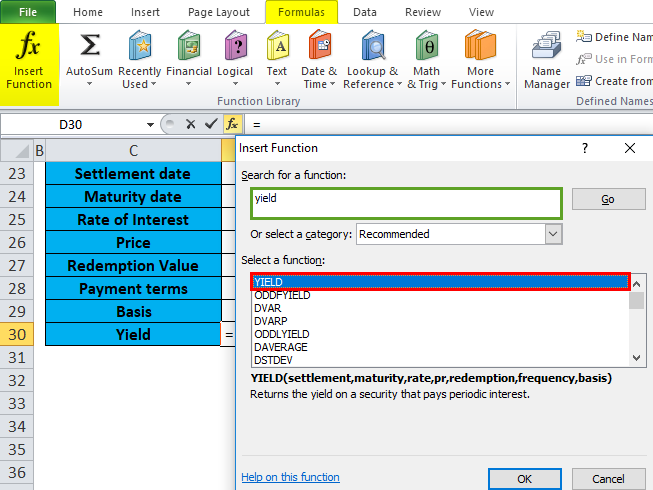

As you can see the YIELD function returns 512 % using the formula in the formula box having more arguments like discount rate, redemption, payment frequency and basis Resulting cell may return number in General format, change the format cell to PercentageThe YIELD function in Microsoft® Excel is used to calculate the Yield of a security that pays periodic interest Looking for methods to use the YIELD functioSelect the cell "D30" where the YIELD function needs to be applied Click the insert function button (fx) under the formula toolbar, a dialog box will appear, type the keyword "YIELD" in the search for a function box, the YIELD function will appear in select a function box Double click on the YIELD function

Yield Function In Excel How To Use Excel Yield Function Youtube

How To Use Excel Yield Function Excelinexcel

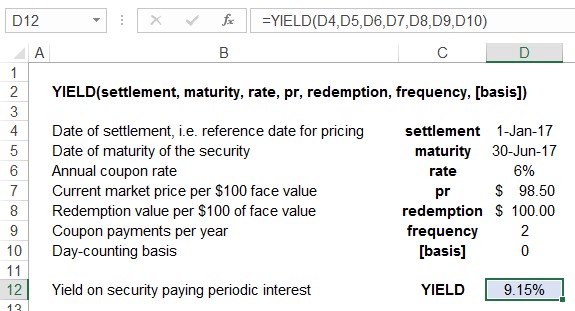

The formula's syntax is YIELD (settlement, maturity, rate, pr, redemption, frequency, basis Settlement refers to the settlement date ie the reference date for pricing, maturity is the maturity date ie the date on which the securityholder receives principal back, Pr stands for the current market price of the security;It by computing how you get at maturity with such a rate you get (102,,*%*276/365)=105, In fact xirr gives the same result as yield only when the settlement date is equal to the issue or a coupon date (ie when the accrued coupon is 0 at settlement date)Frequency refers to number of periodic interest

Calculating The Bond Equivalent Yield For A Treasury Bill Tbilleq

Yield Function In Excel Formula Examples How To Use Yield

How can I use negative yield in Price function ?Since YIELD is the IRR of the cash flows, in this simple case, we can approximate the YIELD with the following formula =RATE (A6* (YEAR (A3)YEAR ()),100*/A6,A5,100)*A6 That assumes that maturity date minus settlement date is exactly 1 or more years That is, the maturity date is an anniversary of the settlement dateThe YIELD function returns the yield on a security that pays periodic interest In the example shown, the formula in F6 is = YIELD( C9, C10, C7, F5, C6, C12, C13) with these inputs, the YIELD function returns 008 which, or 800% when formatted with the percentage number format

Finding Yield To Maturity Using Excel Youtube

Yield Function Formula Examples Calculate Yield In Excel

The Excel YIELD Function is categorised under financial function YIELD function helps to calculate the yied on a security that pays periodic interest Purpose of Excel YIELD Function Helps to get yield for security that pays periodic interest Useful in arriving at bond yields Return value YIELD function returns yield as percentage value Syntax = YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)To calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (eg, A1 through A3)In the following spreadsheet, the Excel Yieldmat function is used to calculate the annual yield for a security purchased on 01Jan17, with issue date 01Jul14 and maturity date 30Jun18 The interest rate at date of issue is 55% and the security has a price of $101 per $100 face value

Quant Bonds Between Coupon Dates

Excel Yield Function

BDS formulas gives multicells of data such as company description, index members' weightage, top holders, etc Formula =BDS(ticker, field) Example =BDS(PSI Index, indx mweight, "cols=2;rows=") For template with formulas set up, enter API > click Sample Spreadsheet > choose Tutorials > Bloomberg APIThe Excel YIELD function is a Financial formula that calculates and returns the yield on a security that pays a periodic interest A common use case for the YIELD function is calculating bond yieldsHere, you'll need to use the MID formula with the following structure =MID(Cell where the string is located, Starting position of the first character needed, Number of characters needed) (2) Now type the following formula in cell B2 =MID(,4,5) (3) Finally, drag the MID formula from cell B2 to B4 This is how the table would look like

Excel Yield Function

How To Use The Excel Oddlyield Function Exceljet

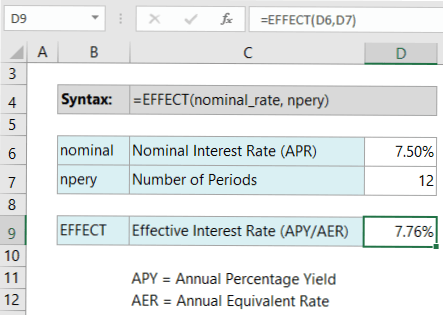

Compound Interest in Excel Formula Compound interest is the addition of interest to the principal sum of a loan or deposit, or we can say, interest on interest It is the outcome of reinvesting interest, rather than paying it out, so that interest in the next period is earned on the principal sum plus previously accumulated interestFormula Description (Result) Result =YIELD(,A3,,A5,A6,,A8) The yield, for the bond withExcel Formulas PDF is a list of most useful or extensively used excel formulas in day to day working life with Excel These formulas, we can use in Excel 13 16 as well as 19 The Excel Functions covered here are VLOOKUP, INDEX, MATCH, RANK, AVERAGE, SMALL, LARGE, LOOKUP, ROUND, COUNTIFS, SUMIFS, FIND, DATE, and many more

Best Excel Tutorial How To Calculate Yield In Excel

Bond Price Calculation In Excel Example

Use the Yield Function to Calculate the Answer Type the formula "=Yield(B1,B2,,B4,B5,B6,)" into cell B8 and hit the "Enter" key The result should be percentwhich is the annual yield to maturity of this bond* We assume we have (int)timeToMaturity/frequency future periods and the running period has * an accrual period of timeToMaturity frequency * ((int)timeToMaturity/frequency) * * @param timeToMaturity The time to maturity * @param coupon Coupon payment * @param yield Yield (discount factor, using frequency 1/(1 yield/frequency)The Excel YIELD Function is categorised under financial functionYIELD function helps to calculate the yied on a security that pays periodic interest Purpose of Excel YIELD Function Helps to get yield for security that pays periodic interest Useful in arriving at bond yields Return value

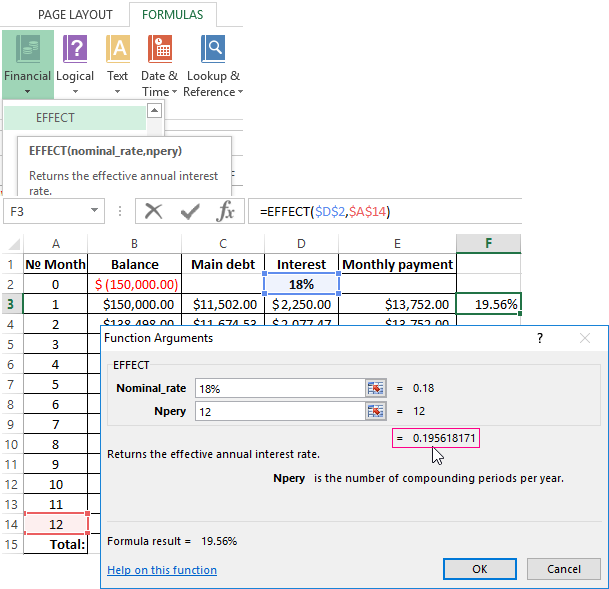

Calculation Of The Effective Interest Rate On Loan In Excel

Over 30 Bond Risk Management Functions In Excel Clean Dirty Price Yield Duration Convexity Bps Dv01 Z Spread Etc Resources

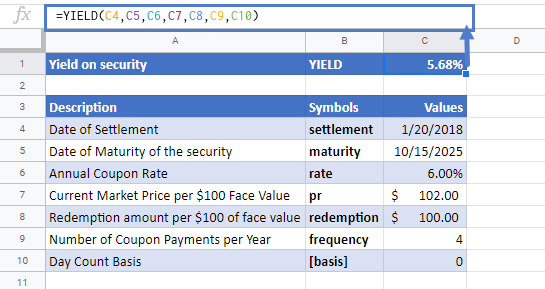

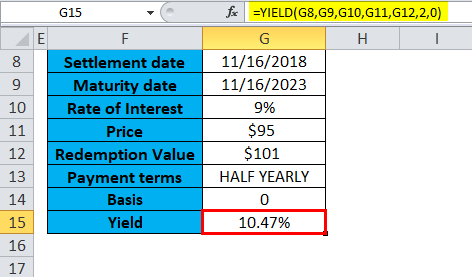

The formula used to calculate the Yield is =YIELD (C4,C5,C6,C7,C8,C9,C10) The YIELD function returns the yield of security YIELD = 568% Here the price of the security argument (pr) and redemption argument (redemption) is entered as the value per $100 regardless of the actual face value of the security=PRICE("16june","16june30",0100%,0100%,100,1,1) //Working =PRICE("16june","16june30",0100%,0100%,100,1,1) //Not Working returns #NUMBERCompound Interest in Excel Formula Compound interest is the addition of interest to the principal sum of a loan or deposit, or we can say, interest on interest It is the outcome of reinvesting interest, rather than paying it out, so that interest in the next period is earned on the principal sum plus previously accumulated interest

Effective Interest Rate Formula Excel Free Calculator Exceldemy

Best Excel Tutorial How To Calculate Yield In Excel

Yield Function in Excel Excel Yield Function is used to calculate on a security or a bond which pays the interest periodically, the yield is a type of financial function in excel which is available in the financial category and is an inbuilt function which takes settlement value, maturity, and rate with bond's price and redemption as an input In simple words the yield function is used toThe english function name YIELD() has been translated into 17 languages For all other languages, the english function name is used There are some differences between the translations in different versions of ExcelExplanation if the score is less than 60, the nested IF formula returns F, if the score is greater than or equal to 60 and less than 70, the formula returns D, if the score is greater than or equal to 70 and less than 80, the formula returns C, if the score is greater than or equal to 80 and less than 90, the formula returns B, else it returns A

Function Duration

How To Calculate Yield To Maturity In Excel With Template Exceldemy

1 Enter a negative yield to calculate the price of a bond Set up a worksheet with the following data Enter this formula in B8 =YIELD (B1,B2,,B4,B5,B6,)Yield is different from the rate of return, as the return is the gain already earned, while yield is the prospective return Formula = YIELD(settlement, maturity, rate, pr, redemption, frequency, basis) This function uses the following arguments Settlement (required argument) – This is the settlement date of the security It is a date after the security is traded to the buyer that is after the issue dateWhat is the math formula to proof excel calculation 3426 as my example above Alternatively, note that the yield to maturity is the IRR of the cash flows So we might use the Excel RATE, IRR or XIRR function to convince ourselves that the YIELD function is returning the correct value Here is how Yatie wrote previously Face value 100

Yield To Maturity Formula Step By Step Calculation With Examples

Excel Yield Function Equivalent In Python Quantlib Quantitative Finance Stack Exchange

In this article, we will learn How to use the YIELD function in Excel Scenario When working with the deposited security or bond value Sometimes we need to find the Yield interest that shows how much income has been returned from an investment based on initial security, but it does not include capital gains in its calculationNo computer speak, just plain English and practical examples of Excel functions used in formulas Before we dive into the examples I want to cover some terminology that I'll be using Anatomy of an Excel Function Excel functions comprise of the function name and arguments, as you can see in the example belowSimilarly to the CONCATENATE function, you can use "&" in Excel to combine different text strings, cell values and results returned by other functions Excel "&" formula examples To see the concatenation operator in action, let's rewrite the CONCATENATE formulas discussed above Concatenate the values in A1 and B1 =A1&B1

Excel Yield Function Youtube

How To Calculate Pv Of A Different Bond Type With Excel

Function Description The Excel YIELD function calculates the Yield of a security that pays periodic interest The syntax of the function is YIELD (settlement, maturity, rate, pr, redemption, frequency, basis)The Excel YIELD function is a Financial formula that calculates and returns the yield on a security that pays a periodic interest A common use case for the YIELD function is calculating bond yields In this guide, we're going to show you how to use the Excel YIELD function, and also go over some tips and error handling methodsTo calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (eg, A1 through A3) In cell , enter the formula "= A1

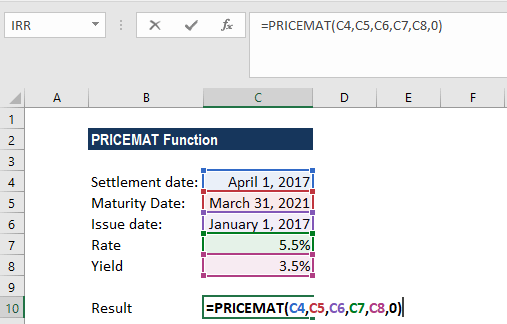

Pricemat Function Formula Examples How To Price A Bond

Best Excel Tutorial How To Calculate Yield In Excel

Microsoft Excel 3 Ways To Calculate Internal Rate Of Return In Excel

Yield Function In Excel Formula Examples How To Use Yield

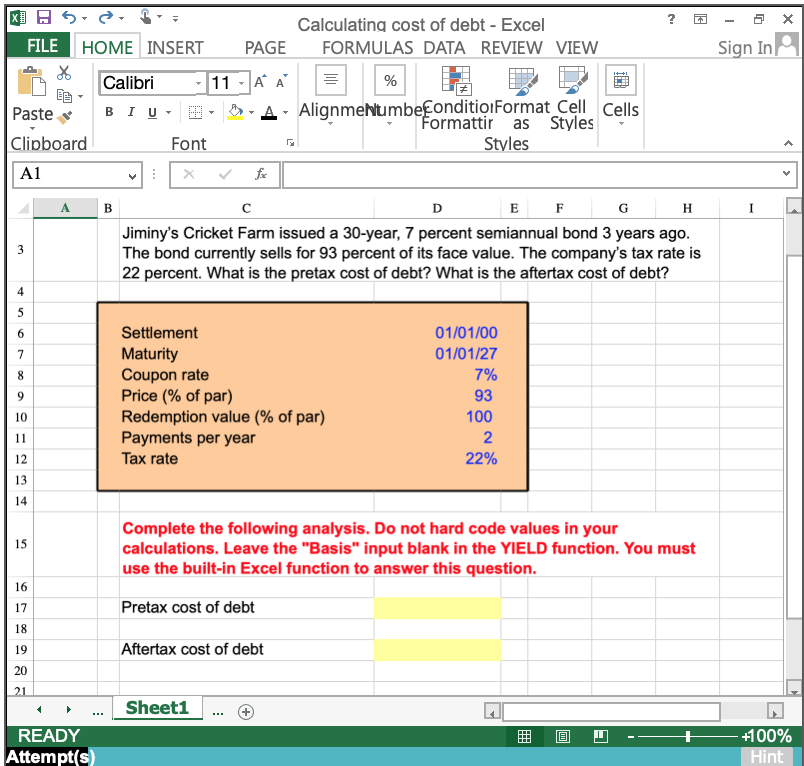

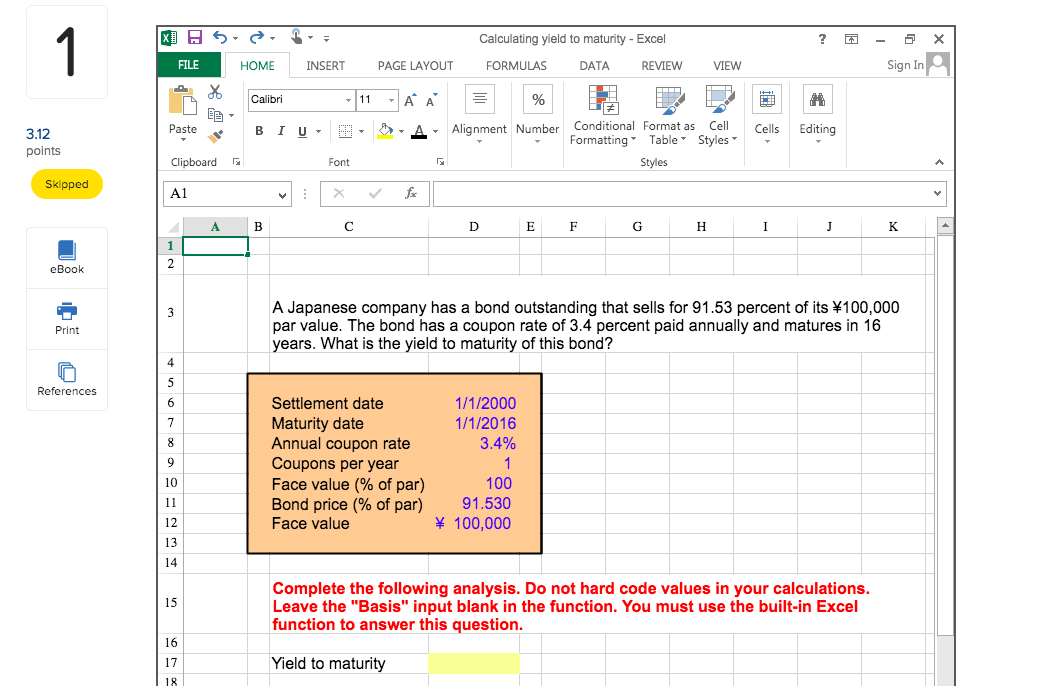

Please Solve Using Excel Please Show Excel Formul Chegg Com

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Yield Function In Excel Calculate Yield In Excel With Examples

Learn To Calculate Yield To Maturity In Ms Excel

Zero Coupon Bond Yield Excel

Pdf 400 Excel Formulas List Excel Shortcut Keys Pdf Download Here

Excel Yield Function

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Quant Bonds Between Coupon Dates

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

How To Use The Yield Function In Excel

How To Use The Excel Yield Function Exceljet

Solved Calculating Cost Of Debt Excel File Home Insert Pa Chegg Com

How To Use The Tbillyield Function In Excel

Calculating Bond S Yield To Maturity Using Excel Youtube

Price Function Office Support

Learn To Use The Excel Yield Function Properly Finance Homework Help

Yield Function In Excel Formula Examples How To Use Yield

Yield Formula Excel Example

Function Price

How To Use Mduration Function In Excel

Yield Function In Excel Formula Examples How To Use Yield

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Yield Function In Excel Calculate Yield In Excel With Examples

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Excel Effect Function My Online Training Hub

Vba To Calculate Yield To Maturity Of A Bond

Best Excel Tutorial How To Calculate Yield In Excel

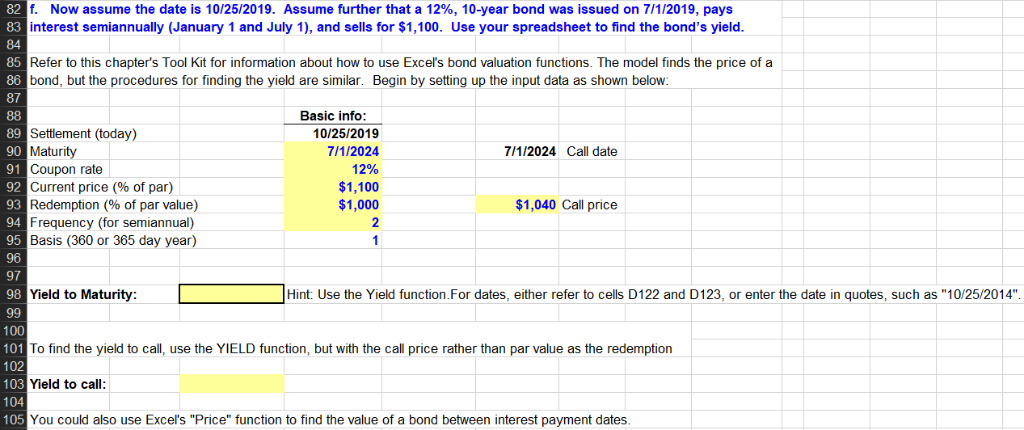

Yield Function In Excel Youtube

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

1

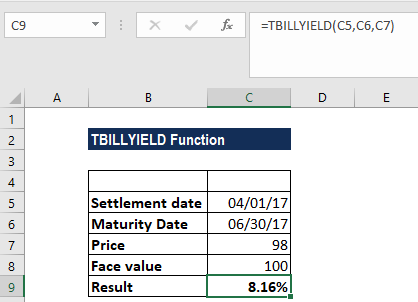

Tbillyield Function Formula Examples Calculate Bond Yield

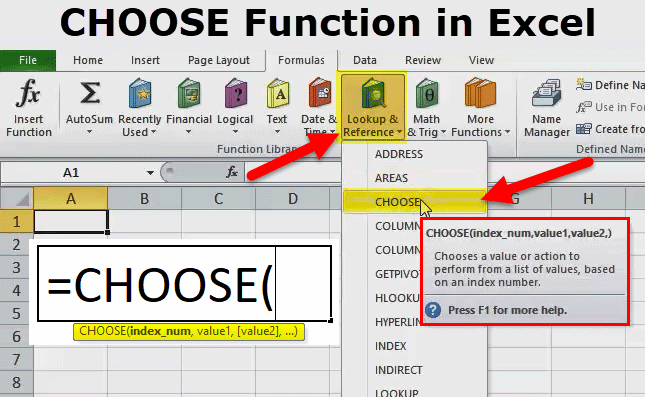

Choose Function In Excel Formula Examples How To Use Choose

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Solved All Answers Must Be Entered As A Formula Click Ok Chegg Com

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Excel Formulas Archives Page 6 Of 23 Spreadsheetweb

How To Use The Excel Yieldmat Function Exceljet

Yield Function In Excel Formula Examples How To Use Yield

Excel Yield Function

How To Use The Duration Function In Excel

Yield To Maturity Ytm Definition Formula And Example

How To Use The Price Function In Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

How To Use The Yield Function In Excel

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

Yield Function In Excel Calculate Yield In Excel With Examples

Excel Yield Function Double Entry Bookkeeping

1

Excel Formulas And Functions Should Be Used For Th Chegg Com

Price In Excel Formula Examples How To Use Price Function

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Q Tbn And9gct1q6zxynbcvmgspi Wpg Zzjvgvz 1ltnjyviqmbaypurzxz Usqp Cau

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Effective Interest Rate Formula Excel Free Calculator Exceldemy

How To Use The Excel Duration Function Exceljet

Is Yield Rate If Redemption Price Irrespective Of Other Microsoft Community

Solved After Recently Receiving A Bonus You Have Decided Chegg Com

Yield Function In Excel Formula Examples How To Use Yield

Yield Function In Excel Calculate Yield In Excel With Examples

Yield Function In Excel Formula Examples How To Use Yield

Solved Calculating Dividend Yield And Capital Gains Yield Chegg Com

How To Use The Excel Yield Function Exceljet

Excel For Finance Top 10 Excel Formulas Analysts Must Know

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

Yield To Maturity Calculation In Excel Example

Calculating The Annual Yield Of A Security That Pays Interest At Maturity Yieldmat

Ranking Functions In Excel Real Statistics Using Excel

Calculating The Yield Of A Treasury Bill Tbillyield

Yield Formula Excel Example

Advanced Excel Financial Yield Function Tutorialspoint

コメント

コメントを投稿